If you are a member of the governing body or management of a New Jersey municipal or county government (local government), chances are you are overwhelmed by the amount of information issued by the State of New Jersey and the Federal Government for the Coronavirus Local Fiscal Recovery Fund (LFRF) provided by the American Rescue Plan Act of 2021 (ARP). In this article, we present an overview of the resources available to recipients of the LFRF. At Bowman & Company LLP, we review the material as it is issued and can be a resource to you as you navigate compliance with the funding.

If you are a member of the governing body or management of a New Jersey municipal or county government (local government), chances are you are overwhelmed by the amount of information issued by the State of New Jersey and the Federal Government for the Coronavirus Local Fiscal Recovery Fund (LFRF) provided by the American Rescue Plan Act of 2021 (ARP). In this article, we present an overview of the resources available to recipients of the LFRF. At Bowman & Company LLP, we review the material as it is issued and can be a resource to you as you navigate compliance with the funding.

The ARP is a federal law that was enacted on March 11, 2021, to provide funding for the COVID-19 pandemic response and recovery. The LFRF funds provided under the ARP are being released in two stages (tranche), first in 2021 and the second in 2022. The amount for each municipal tranche is available here. The document lists each municipality in one of two groups, metropolitan or non-entitlement units (NEUs), based on its population. The group is essential because counties and metropolitan municipalities will have direct funding from the federal government, and NEUs will receive funding through the State of New Jersey. Reporting requirements differ for each group. The allocations for counties are available here.

The State of New Jersey Division of Local Government Services (DLGS) has issued two Local Finance Notices (LFN) regarding the LFRF funding. LFN 2021-11 published in June 2021, followed by LFN 2021-13 in August 2021. These Local Finance Notices provide information that the State of New Jersey has issued to guide local governments in the funding requirements; however, significant portions are links to other documents and online resources.

What can you do to gain an understanding of the requirements of the LFRF funding?

Review LFN 2021-11 American Rescue Plan Act of 2021: Requirements for Grant Funds which provides a significant amount of information through links as well as some information on the permitted uses of the funding, period of performance dates, reporting requirements, and the budgeting and recording the receipts received in 2021. The following table provides each of the links and a brief description:

|

Links in LFN 2021-11 |

Brief Description |

|

The federal website within the U.S. Department of Treasury for the LFRF |

|

|

The Federal Register (rules and regulations) for the LFRF |

|

|

A broad notice about national-level funding and planned uses issued on May 10, 2021, by the U.S. Department of Treasury |

|

|

LFRF frequently asked questions (FAQ) currently dated as of July 19, 2021. The FAQ document is about eligibility and allocations, eligible uses, ineligible uses, reporting, and other miscellaneous FAQs. This document contains links to other resources. |

|

|

A two-page pamphlet issued by the U.S. Department of the Treasury about the LFRF |

|

|

|

The LFN contains information about obtaining a DUNS number required for federal funding. The link is for the request portal. |

|

|

The LFN contains information about registering with the federal government’s System for Awards Management (SAM), required for reporting for the LFRF. The link is a guide to registering with SAM. The LFN also includes a link to SAM. |

|

Assurance of Compliance with Title VI of the Civil Rights Act

|

Provides information on the requirement to execute Assurance of Compliance with Title VI of the Civil Rights Act, a condition for receiving federal financial assistance. |

|

Directly Request Grant Funding

|

For counties and metropolitan municipalities – A link to the section of the federal website for the direct request of funds by counties and metropolitan municipalities. |

|

Financial Assistance Agreement

|

For counties and metropolitan municipalities – A link to the Financial Assistance Agreement that counties and metropolitan municipalities must execute with the federal government. |

|

Award Terms and Conditions Agreement

|

For non-entitlement municipalities (NEUs) – The Award Terms and Conditions Agreement that NEUs must execute. |

|

Local Fiscal Recovery Fund Distribution Request and Certification Form

|

For non-entitlement municipalities (NEUs) – The Local Fiscal Recovery Fund Distribution Request and Certification Form is required by the DLGS when requesting payment from the State. |

|

Revenue Loss Calculation Worksheet

|

A link to the revenue loss calculation worksheet provided by the DLGS |

|

|

Counties and municipalities intending to directly or indirectly undertake a broadband project should review P.L. 2007, c. 191 (N.J.S.A. 40:9D-1 through 40:9D-8) to determine whether the law applies to the project and, if so, whether the law requires Local Finance Board approval of the project. |

|

|

P.L. 2021, c. 69, effective April 30, 2021, expands the permissible use of project labor agreements beyond contracts for building-based public works projects. It permits projects such as highways, bridges, pumping stations, water supply systems, and sewage treatment plants, so long as those contracts are subject to prevailing wage and valued at over $5 million exclusive of land acquisition costs. |

|

|

For addressing COVID-19 related Negative Economic Impacts, this link is to the DLGS Local Assistance Bureau, which offers comprehensive management consulting services at no cost. |

|

DCA Division of Housing and Community Resources

EDA Small Business Emergency Assistance Grant Program

|

Websites for the Department of Community Affairs (DCA) division handling housing and rental assistance and the Economic Development Authority (EDA) for small business assistance are needed to help avoid duplication of benefits. |

Review LFN 2021-13 American Rescue Plan Act of 2021: Supplemental Compliance & Reporting Guidance, which provides an overview of recent LFRF guidance, including a significant amount of information through links. The following table lists each of the links and a brief description:

|

Links in LFN 2021-13 |

Brief Description |

|

United States Treasury Guidance

|

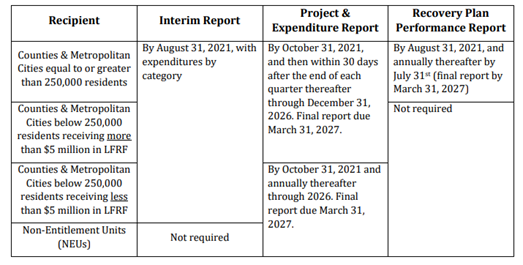

The 35-page guide titled Compliance and Reporting Guidance State and Local Fiscal Recovery Funds. The guide has helpful information presented under General Guidance, Reporting Requirements, and an appendix for expenditure categories and evidence-based intervention additional information. It also contains the table of reporting timelines presented later in this article. |

|

|

The LFRF Federal website, where there are webinars and copies of presentations on a range of subjects related to the funding |

|

New Jersey Office of State Controller LFRF

|

A link to the Office of the State Controller website section for the LFRF with information on best practices and an internal control checklist. |

|

|

These links are a repeat from LFN 2021-11. LFN 2021-13 uses them to address the use of LFRF funds for staffing – sustainability considerations. |

|

Recipient Reporting Supplemental User Guide

|

A guide titled Treasury’s Portal for Recipient Reporting State and Local Fiscal Recovery Funds. This supplemental user’s guide contains detailed instructions for submitting the Interim Report and Recovery Plan Performance Reports explained beginning on page 12 of the 35-page guide provided in the first link of LFN 2021-13. |

|

|

A link to the Assistance Listing for CFDA 21.027 LFRF, which contains statutory and regulatory requirements. |

LFN 2021-13 and the Compliance and Reporting Guidance State for Local Fiscal Recovery Funds guide provide this chart of reporting requirements.

LFN 2021-13 addresses in more detail several of the permitted uses of LFRF.

Use of LFRF Proceeds to Offset COVID-19 Attributable Revenue Losses

Before the issuance of LFN 2021-13, there had been conflicting information about how counties and municipalities would handle the use of LFRF funds for revenue loss. The following statement from the LFN addresses this conflict.

“Due to the updated U.S. Treasury guidance, the Division counsels local units to not record LFRF funds as Municipal Revenue Not Anticipated.”

Since the LFN addresses revenue loss in detail, it should be consulted for guidance if it is one of the local government’s planned uses of the funding.

Other permitted uses described in detail in the LFN

If one or more of the following are the planned uses of the funding, the local government should follow the guidance presented in the LFN.

- Crime Prevention and Response

- Premium Pay

- Small Business Assistance

- Aid to Travel, Tourism, and Hospitality or Other Impacted Industries

- Administrative Costs and Audit Expenses

- Subrecipient Compliance Monitoring

Conclusion

As your county or municipality navigates the process for its allocated funding, we hope the overview provided in this article is helpful. The professionals at Bowman & Company LLP are here to assist you. As the rules and regulations continue to unfold, we will publish additional articles on important matters related to this significant funding, including those focused on establishing best practices and internal controls.

{{cta(’85e83cdb-a7d8-43e0-8ce4-ce52431643a6′,’justifycenter’)}}